2022 Goat Industry Update

Goat Industry Update 2022, Part 2

Ken McMillin and Frank Pinkerton

Introduction

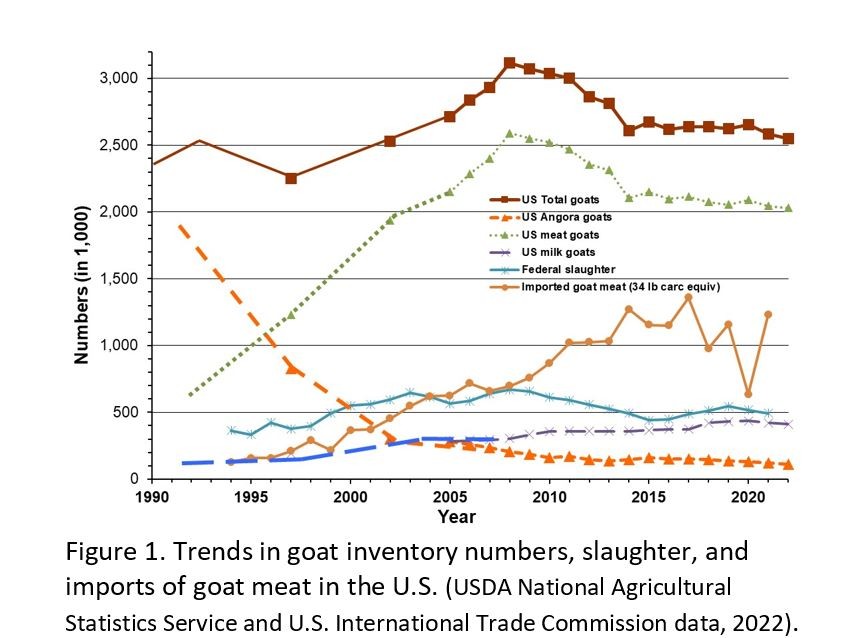

This is the second update on the goat industry. The first part of our annual Goat Industry Update in the March 2021 issue of Goat Rancher provided data on the U.S. goat industry. The first figure from that article is shown because it compares not only the status of the different production segments of the U.S. goat industry (total, meat, milk, Angora), but also includes the latest goat meat imports and U.S. federal goat slaughter as of the end of the years 1990 to 2021.

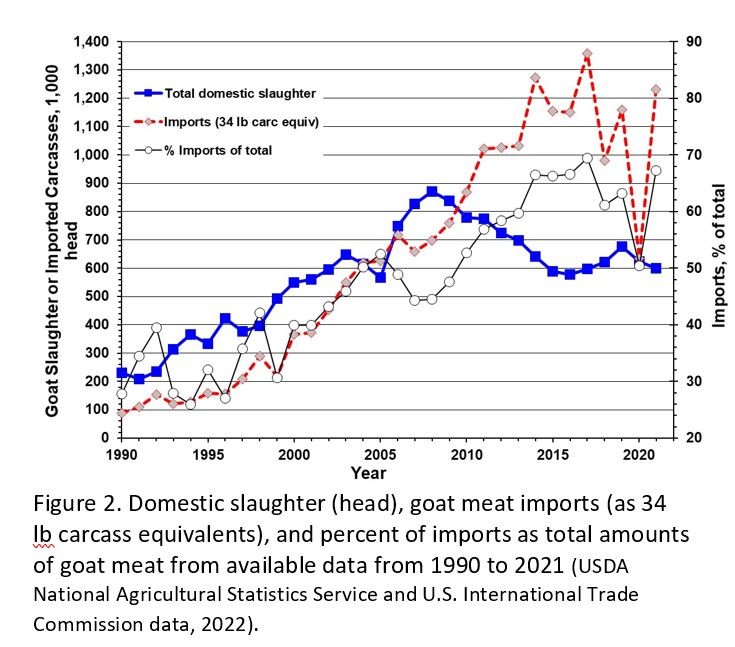

The number of goats slaughtered domestically decreased by almost 6% and the imports of goat meat (as 34 lb goat carcass equivalents) almost doubled compared with 2020 values (Figure 2). The goat meat imported as fresh and frozen carcasses and primal cuts increased by 93% compared with 2020 and was the 3rd highest poundage of imported goat meat since 2004. Recall that imports in 2020 were only 45% of those from 2019 and the 2021 imports were 2.5 million pounds more than in 2019. Imports of goat meat were higher only in 2014 and 2019 than last year. Goat meat imports from Australia provided the predominant amount of goat meat (84.7%) while the remainder was from Mexico (8.4%) and New Zealand (7.0%). The most recently available data indicates that 29,714 goats were slaughtered in Mexico in 2020, but not what proportion of that goat meat was exported to the U.S. Mexico only exported its goat meat into the U.S. at a value of $3.33 million.

In the first quarter of this financial year, about 370,000 goats were processed in Australia, a 75% increase over the same period last year. About 95 per cent of Australian goat meat comes from the rangelands and is processed for export markets, but the supply of feral range goats is volatile due to season and weather. Meat and Livestock Australia, a trade and marketing organization, is placing an emphasis on farmed goat production and domestic consumption. Strategic plans are being developed to increase the numbers of farm raised goats to address both the domestic and export markets. Australia also sends live goats to parts of Asia and the Middle East. These factors make the amounts of Australian goat meat that will be available for export to other countries, including the U.S., difficult to predict. There were 180,812 goats slaughtered in New Zealand last year, but their industry has not increased goat or goat meat production.

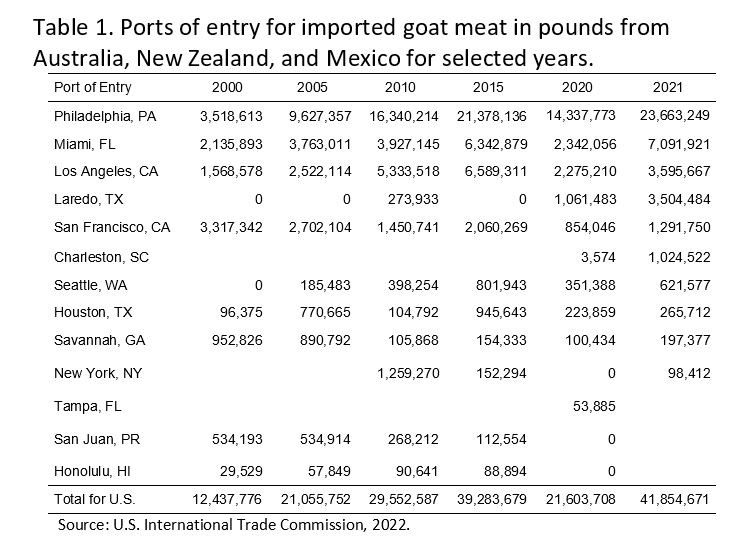

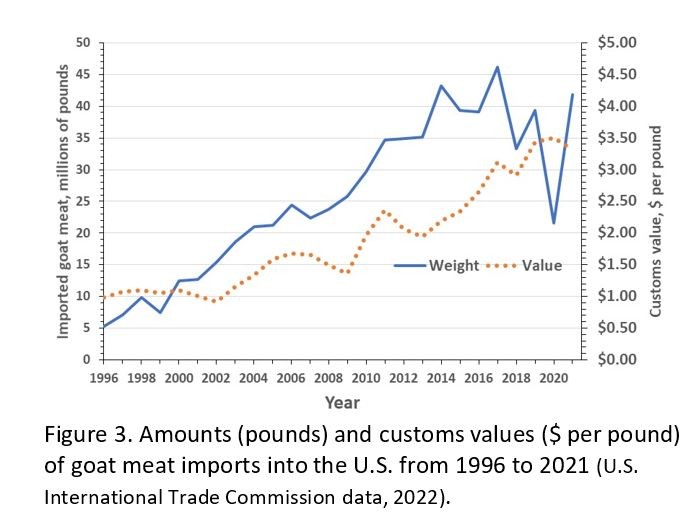

As a result of the increased imported goat meat supply, the average declared custom values were lower by $0.40 and $0.25 per pound than in 2020 and 2019, respectively (Figure 3). The average declared custom values have tended to increase during the last 25 years along with the continuing ethnic consumer demand for goat meat. As indicated in previous update reports and columns, the threshold price per pound at which ethnic buyers will choose meat sources other than goat meat has not been determined. The prices for live goats at the San Angelo market continue at historic highs, even with increased numbers of kid and older goats being marketed due to the extreme and exceptional drought conditions in most of Texas and severe and extreme drought in most western states.

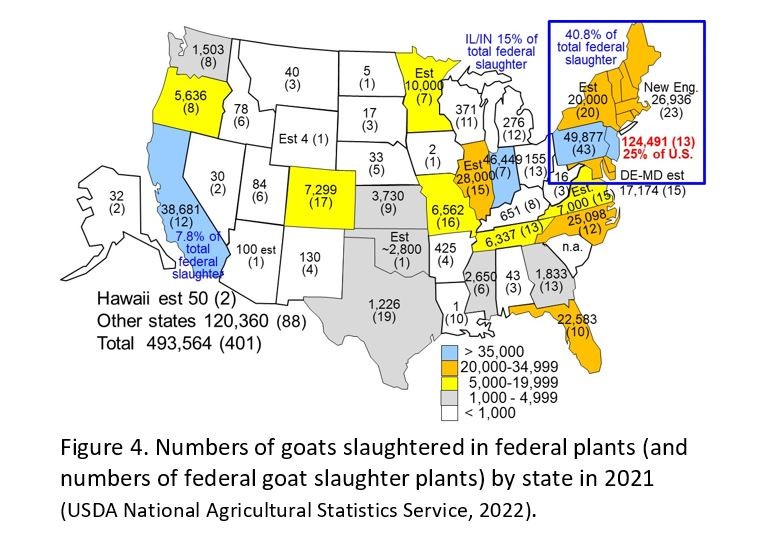

The major U.S. ports of entry for goat meat increased their imports by more than double compared with 2020, and at about 2019 levels (Table 1). Philadelphia remained the major port of entry (56.5%) while 16.9% arrived in Miami and 8.6% in Los Angeles. No goat meat was reported to enter through Tampa, San Juan, or Honolulu ports last year. Laredo remained the 4th largest importer of goat meat with San Francisco 5th and Charleston 6th. This continued the trend from last year. The customs value of imported goat meat ranged from $2.83 to $4.03 per pound, depending upon the month, exporting country, and port of entry. There are also fees and taxes that vary with port that influence somewhat the volumes of goat meat entering a specific port. The retail price of imported goat meat reflects the costs of harvest, shipping, frozen storage, distribution to points of sale, and markup. Imported goat meat retail prices have been only about half of domestic goat meat in the recent past. Domestic fresh goat meat is preferred by many ethnic consumers who are willing to pay a premium for it.

The numbers of goats slaughtered and, in parentheses, the number of federal plants that slaughter goats in each U.S. state are in Figure 4. There are estimates of the number of goats slaughtered in federal plants in states where providing the specific slaughter numbers would disclose information about specific companies in that state. The actual number of goats slaughtered in federal plants in those states are included in the total for the other states category.

The U.S. federal slaughter decreased by 6% in 2021 (493,173) compared to 2020 (524,244) and is only 73% of the ~676,500 goats slaughtered in federal plants in 2008, the year of highest meat goat inventory numbers in the U.S. New Jersey and the other northeastern U.S. states accounted for 41% of all of the goats slaughtered under federal inspection. This was down by 3% from 2020, perhaps due to higher prices for goats that depressed ethnic Northeast demand or fewer numbers of goats available. These states, along with Indiana and Illinois, slaughtered 56% of all goats sacrificed in federal plants. The inefficient goat and goat meat logistics system has live goats transported to packing plants nearer consumers rather than having processing plants located near areas of production and shipping of the meat to consumer centers as occurs with other livestock and avian species. This is due to the demand for fresh goat meat, often cut from carcasses on demand, by consumers compared with prepackaged and self-service sales of other meat species. This increased inefficiency of the goat meat food chain system increases the costs of the end goat meat products, particularly with increased production and logistic costs due to inflation, along with the live weight shrinkage loss when goats rather than meat are transported long distances.

The 2021 slaughter in state inspected plants was 105,000, down by 1.3% from 2020, for a total reported 598,500 goats slaughtered in U.S. inspected facilities last year. State and federal inspected plants must meet the same hygiene and sanitation requirements, but goat meat produced in state inspected plants cannot be transported across state lines and then sold. Overseas plants producing meat for export to the U.S. have been audited and approved by USDA Food Safety and Inspection Service to meet the same hygiene and sanitary requirements as U.S. federal meat plants. Without repeating the data from previous articles and years, the U.S. doesn't produce nearly enough goats to meet the domestic demand for goat meat. The "informal" slaughter where individuals purchase a live goat and sacrifice the animal themselves is unknown. The number of goats used as food in this manner may be from 25 to 50% of the goat slaughter numbers reported by inspected meat plants. This is due to the differences between slaughter numbers and estimates of kid crops, does, replacement breeding stock, predator and other losses, and other data and observations.

Goat industry trends

As cited in Part 1, CY 2021 showed a drop in ending inventory numbers of meat goats of 2% and also a similar drop in numbers of goats slaughtered. Our speculation from last year that both domestic inventory and numbers would trend slightly downward in 2021 was an underestimate of the actual declines observed. The improved production situation in Australia that caused an almost doubling of imported goat meat into the U.S. did not cause a decline in U.S. auction prices for live goats. It is puzzling to us that most U.S. producers are not increasing herd sizes, improving kidding rates through better management, or raising kid goats to heavier weights since goat production profitability now exceeds that of cattle on the same acreage and the prices for kid goats remain at historic levels.

It is recognized that all farming operations are influenced by weather. As indicated previously, the severe drought conditions in many locations are causing producers to send kids and many does to auction. Spotty and infrequent rains and uncertain economic conditions make prognostication impossible, but based upon the year to date, we speculate that 2022 will see a further decline in meat goat numbers. The number of goats slaughtered is unpredictable due to the number of does going to auction. Breeding stock prices have paralleled the record high prices for slaughter goats. Doelings for fall 2022 delivery are up in price (ranging $350 to $400/head), but this trend is likely heavily dependent upon rebounding of favorable weather. The average number of goats on goat farms is typically small, between 20 and 40 head, depending on the survey or data reporting agency. This trend seems to also continue with the exception of some large herds that are expanding and by some entrepreneurs who are initiating more intensive, confinement-oriented operations. In general, the meat goat industry is not responding to the pressing need for more slaughter goats. We've not developed any concrete reasons for this in view of the increases in net income that can be achieved. The strategies to increase the amount of domestic goat meat only require some operational adjustments. In increasing numbers of markets, there is a rapidly diminishing price differential between prices for kids weighing less than 80 pounds and those weighing more than 80 pounds.

Concluding Remarks

Although we are retired from academia, we remain involved in the goat world through consultation activities, brokering goats, and interactions with university colleagues. Our many years of individual and collective production and marketing experience with goats and goat meat do come with limitations. We're always willing to interact by phone, email, and slow-mail and are not hesitant to refer you to other goat experts as needed.

Click to enlarge

Click to enlarge Click to enlarge

Click to enlarge Click to enlarge

Click to enlarge Click to enlarge

Click to enlarge Click to enlarge

Click to enlargeUpcoming Events

Cornell Organic Field Crops & Dairy Conference

March 6, 2026

Waterloo, NY

Farmers, researchers, educators, and agricultural service providers from across the Northeast are invited to the 2026 Cornell Organic Field Crops & Dairy Conference, held Friday, March 6, 2026, from 8:00 a.m. to 4:30 p.m. at the Lux Hotel & Conference Center in Waterloo, N.Y.

Co-hosted by New York Soil Health and Cornell CALS, the annual conference brings together leaders in organic grain, dairy, and livestock systems to share practical tools, new research, and farmer-tested strategies to support resilient and profitable organic production.

NY Pork Producers - 2026 Producer Summit & Annual Meeting

March 13 - March 14, 2026

Hamilton, NY

Join NYPP for the 2026 Producer Summit, where producers of all sizes and production styles will explore marketing, branding, selling pork, and current consumer trends through practical sessions designed to help build demand, connect with customers, and add value to their operations.

Mid Atlantic Grain Conference

March 15 - March 16, 2026

We're excited to share that the 2026 Mid‐Atlantic Grain Fair & Grain Conference is coming March 15-16, 2026 in Pennsylvania! This two-day event brings together farmers, millers, bakers, brewers, distillers, researchers, and grain enthusiasts to learn, connect, and celebrate local grains. These events will be offered at two seperate locations.

Announcements

No announcements at this time.