Calculating Your Cost of Production - Start with Knowing Your Numbers!

Katelyn Walley, Business Management Specialist and Team Leader

Southwest New York Dairy, Livestock and Field Crops Program

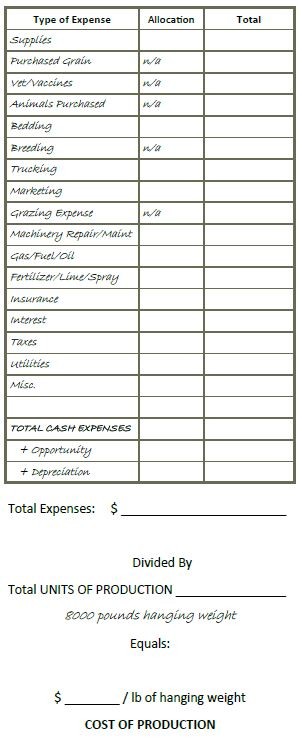

Cost of Production is a financial analysis tool for farms of all shapes and sizes to use to improve their decision making capacity and operate their farm business profitably. Cost of production is calculated by adding the costs associated with a certain farm enterprise (or production area), and dividing that by the total units of production over a designated time frame (usually a year).

Knowing your cost of production can help determine breakeven prices for profitability, make cost-saving decisions, find the biggest opportunity for return on investment for your farm, benchmark your performance, and more. You could be the best farmer in the world, doing all of the right things, but if you're not bringing in more money than it costs for you to produce what you're selling, you won't be a sustainable business. Being a good farmer doesn't guarantee success - you also have to be a good business manager and financial analysis is an important process.

The main requirements to calculate a cost of production are good records, time, and motivation. Records should include incomes by value and production unit, expenses and their allocation towards different farm enterprises, an estimate of the value of management labor and skills, and inventories of assets that include feed, supplies, and animals. Successful farmers set aside our most limiting input - time - to perform financial analysis. Having sound numbers can often save you time at the most critical moments! Finally, motivation to calculate your cost of production, knowing your "why bother" is important to keep in mind throughout the process. The first time through calculating your cost of production can be frustrating, but the end result is rewarding and future calculations will go much more smoothly!

One of the hardest parts of calculating cost of production is allocating expenses by individual enterprises. An enterprise on a farm is a "bucket" of production, or one production area. For farms that only produce and sell one product to similar markets, there will only be one enterprise. For farms that might have multiple enterprises, all of the farm expenses must be allocated accordingly. For example, a farm might operate a tractor for their business that includes beef, hay sales, and egg sales. The use of the tractor (repairs, maintenance, interest on the equipment loan, depreciation) must be allocated in proportion to its use for each enterprise. In the above example, the tractor is primarily used for hay production, but some of that hay is used in the beef cows as home-grown feed. An allocation might look like 30% beef (for producing the hay they eat), 60% hay sales (for producing the hay), and 10% poultry (for producing the bedding).

An (overly simplified) Example. Use the following case study to try calculating cost of production on your own!

Get-Rich-Sometime Farm is located in rural Western New York. Husband and wife, Jack and Jill, started their farm in 2010 raising a couple of beef cows for their family. They have continued to grow since then and are operating as a farm business raising beef, poultry, goats, market vegetables, and sell some hay to local horse owners. Jack works part-time as a truck driver and does the majority of the summer hay harvest work. Jill works full-time in town and is finding the balance between that job and the growing farm duties unsustainable.

Initially, their "why bother" was to live the rural life and know where their own food comes from. However, with the growth of their farm business and sales over time, they would now like to both be working full-time on the farm. As such, they're working with their really wonderful and funny Extension agent, Katelyn, to go through a Beef Farm Business Summary and analyze their farm's financial performance. Their hope is to create a sustainable growth plan that would let both of them quit their day jobs within the next few years.

Jack and Jill don't have the best record keeping system, but they have been able to find most of the information they needed. They keep an accordion folder where receipts and slips are filed as they come in by vendor. Usually they go through and tally everything up once a year for their taxes. Then, they do a really good job looking at things and tracking them from January to April (new year, new me), but then once the sun starts shining, things get thrown into a box until they can be sorted.

Katelyn's asking Jack and Jill to work on collecting the information they need to determine their Cost of Production for each of their current entities. First, they'd like to focus on the beef production since that was where they got their start. Currently, Jack and Jill sell beef as whole and halves to their local community. In 2021, they sold 10 steers to 15 different customers for a total of $20,000. Going back through the paperwork from the butcher's, their total hanging weight for those 10 steers was 8,000 pounds.

Next, Katelyn wants to know what the direct expenses were to raise the beef cows. Because of their current record keeping system, they have to go through and "allocate" almost all of their categories that they track. For example, in 2021 the farm claimed $8,500 in supplies as expenses. However, the category of "supplies" ends up being a catch all for all of the random purchases that they don't know how to categorize. Jack and Jill went over all of the receipts to pick out the big purchases and get a better sense for how that should be allocated. It's their best guess that 50% of those supplies were for the Beef enterprise. They're also putting a new system in place for 2022 using the Cornell Beef Farm Account Book to help better track and break down categories by enterprise.

Other expenses that they've calculated are: Purchased grain with a mineral pack ($5,000), vet visits and vaccines ($1200), a few young calves that they bought to raise and then sell ($1,000), sawdust ($800 and 75% is for beef), breeding costs ($400), trucking fees ($250), Beef CheckOff ($10), and $700 in fencing supplies.

Expenses that were a little tougher to allocate were mostly equipment and utility based. Especially when thinking about those things used for hay production since their hay goes to the beef cows, the goats, some for the poultry, some for the market garden, and some as outside sales. However, after looking things over and talking with Katelyn, Jack and Jill are confident that the beef portion of these expenses were: Machinery Repair/Maintenance ($3,000), Gas/Fuel/Oil ($1,200), Fertilizer/Lime/Spray ($600), Interest ($60), Insurance ($400), Taxes ($300), Seeds ($100), and Electricity ($250).

Now, Katelyn wants them to come up with an opportunity cost. They think that this is dumb because they don't want to work or invest their money anywhere else. But, after some discussion, they agree to at least include 3% to stay ahead of inflation, especially because neither of them are really taking a "pay check" from the farm - they might just grab some cash out of the farm stand box to pay for groceries, or use some of the goat checks to cover house bills. To make sure this expense is added, they take all of their total expenses related to the beef enterprise, multiply by .03, and add that as an additional expense.

They're also trying to calculate out the cost of their fixed assets (the land, a barn that the beefers use, the equipment, and a farm truck and trailer). To do this, Katelyn helped them set up a depreciation spreadsheet that's different than their tax depreciation spreadsheet. They use this to value their true cost of depreciation as $1,100 based on the assets as they're used in the beef cows.

Now that they've gotten these numbers and are close to calculating their cost of production, Jack and Jill want to know if their $2.50/lb hanging weight price is at least breaking even with their expenses. If it's not, they'll need to keep discussing ways to move forward to help bring Jack and Jill home on the farm!

Upcoming Events

Boots in the Barn: Cornell Dairy Research Updates

January 13, 2026

January 20, 2026

January 27, 2026

February 3, 2026

February 10, 2026

February 17, 2026

February 24, 2026

Join us for some or all!

New York Certified Organic (NYCO) Field Crops and Dairy Meeting

February 10, 2026

Geneva, NY

Piglet Health 101

February 13, 2026 : Piglet Health 101 - Batavia, NY

Batavia, NY

This free workshop from the New York Pork Producers offers hands-on training in essential piglet care and processing practices, led by industry veterinarians from Passion for Pigs. No matter your experience level, this training offers takeaways for both new and experienced producers.

Announcements

Cows, Crops & Critters Newsletter Sponsorship

TRYING TO REACH GROWERS AND AGRIBUSINESSES IN OUR SOUTHWEST REGION OF NEW YORK?Weekly Email Update: Shared with 625+ households who have signed up with our program.

Monthly Paper Mailer: To reach our stakeholders and farmers who lack internet access, we send out a monthly mailer where your company's logo and contact information would be featured with a mailing list of 330+ households.

If you sponsor our weekly and monthly publications you reach approximately 955 households.