Livestock Report - Jan. 22, 2021

Amy Barkley, Team Leader & Livestock Specialist

Southwest New York Dairy, Livestock and Field Crops Program

Livestock Report - Jan. 22, 2021

Michael J. Baker PhD

Cornell Beef Extension Specialist

mjb28@cornell.edu

$5.50/bu corn. It may be a good year for running stockers.

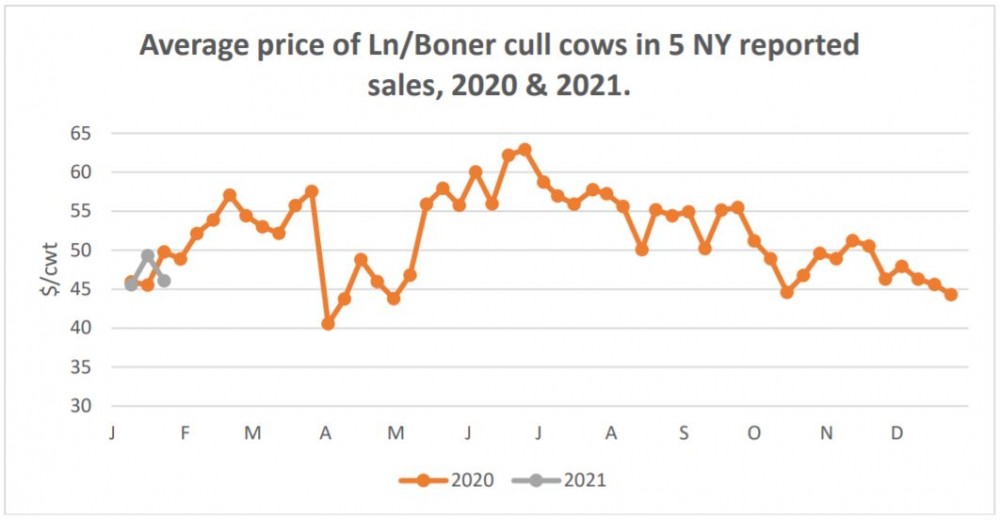

Cull Cows.

The average price for the week ending Jan 16, 2021 of Lean/Boner cull cows in NY was $46.10/cwt. While down from the previous week, the price of cows for the first three weeks of January 2021 are within $.10/cwt of the same time last year. Prices for cull cows from May to December were $2/cwt higher than the same period in 2019. Again, watch the seasonal trend. Looking at the graph below, with the exception of the COVID affected prices in April and May, cow prices are expected to rise through June/July. Depending on your individual situation, this can provide a market opportunity.

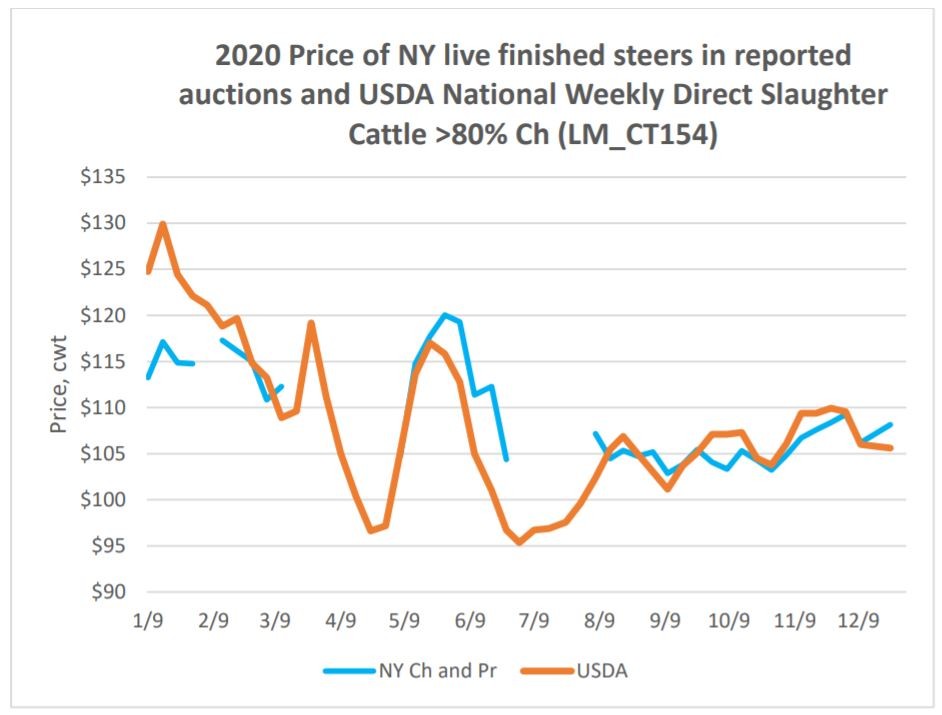

Finished cattle.

The average price for Choice and Prime steers for the week ending 1/16/2021 was $107.30/cwt compared to $108.91 the previous week. The National Weekly Direct Slaughter Cattle reported $108.89/cwt on 1/16/21. Reviewing 2020, prices reported in the NYS Market News were $1/cwt higher than reported in the National Weekly Direct Slaughter Cattle. In New York, the prices for the first three weeks of the New Year are $115.08/cwt and $110.25/cwt for 2020 and 2021, respectively.

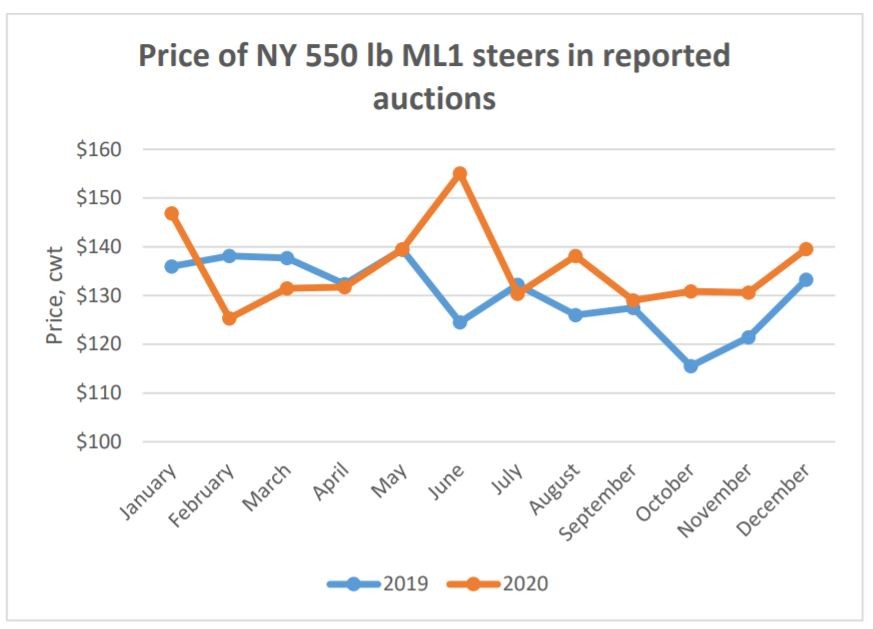

Feeder cattle.

Medium and Large Frame, No. 1 feeder steers finished out 2020 being $5/cwt higher than 2019. Not in either year did we see the historical price in feeders declining into the first of the year. With a significant number of health managed, weaned and reputation feeders showing up in December, this could create a contra-seasonal trend. What makes these calves stand out? How can you capture that similar value?

Stocker Cattle.

I do not ordinarily include in-depth articles, but this one from Dr. Derrell Peel speaks to the feeder calf market as it responds to high grain prices. The bottom line is that there may be a greater opportunity this year for the stocker cattle enterprise than in previous years. For more details, read on.

---

High grain price impacts on the cattle industry

Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

Grain and oilseed prices have risen dramatically in the last three to four months. For example, the weekly cash price of corn reported for Dodge City, Kansas averaged $3.41/bu. from January-September, 2020. The price rose above $4.00/bu. by mid-October and by mid-January 2021 was reported at $5.44/bu. July corn futures are currently priced at $5.20/bu. Market prices for corn are increasing to ensure that demand is rationed to match available supplies and adequate corn is available until the next harvest. Corn demand comes from many different markets including livestock feed, industrial use (primarily ethanol) and exports. As corn prices rise each market will react to reduce corn use in varying degrees according to the economic claim each demand type makes on corn. With corn as the main driver, other feedgrains and by-product feeds will all generally rise proportionally through market arbitrage.

The cattle industry will react to high feed prices somewhat differently than other livestock species. Unlike hogs and poultry, where their monogastric biology means that using less feed implies reducing production, the ruminant biology of cattle means that the industry will use less grain by changing how cattle are produced more than by changing production levels. Indeed, the supply of feeder cattle is mostly determined for 2021 and those cattle will go through the feedlot as usual but with a different production system.

The central decision that determines how feeder cattle get finished and become part of the beef supply is feedlot placements. Individual feedlots often have particular preferences for size, breed and type, gender and overall quality of the feeder cattle they purchase but also flexibility to feed a variety of animals. In general, feedlots can place feeder cattle weighting from less than 600 pounds to over 1,000 pounds. One of the biggest decisions for feedlots is whether to "buy pounds" (place heavier feeder cattle) or "feed the pounds onto the cattle" by placing lighter weight feeder cattle. This decision will change according to feed prices. As high feed prices push feedlot cost of gain up, feedlots have an incentive to "buy more pounds" and place heavier feeder cattle. Thus, the cattle industry responds to corn market signals to use less corn by placing cattle at heavier weights and using other (i.e. forage) feeds to add additional weight to cattle prior to feedlot placement. This is the advantage (and necessity!) of the cattle industry to use the ruminant capabilities of cattle to respond to the corn market situation. If all the cattle finished in feedlots in 2021 (that would have been fed anyway) are placed, say, an average of 100 pounds heavier, the amount of reduction in total concentrate feed use is significant.

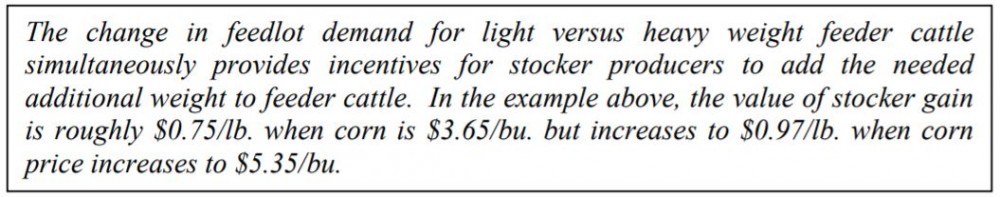

When feedlots demand heavier cattle, prices for lighter weight feeder cattle will decline relative to heavier cattle. For example, the price 825 pound steers in Oklahoma is currently about $131/cwt. When corn is, say $3.65/bu., feedlots would be willing to pay roughly $155/cwt. for a 575 steer based on the cost of gain to put on the 250 pounds from 575 to 825 pounds. When corn price increases to say, $5.35/bu., the increased cost of gain means that the feedlot would only be willing to pay roughly $146/cwt. for a 575 pound steer - even though the price of the 825 pound steer has not changed. Of course, higher feed prices likely also means that the overall feeder cattle price level will decline as well.

Higher corn prices provide incentives for feedlots to change how cattle are finished and those decisions, in turn, will signal the rest of the cattle industry to make production adjustments utilizing the ruminant flexibility of cattle in response to changing feed prices. Relative to a given fed cattle price level, higher feed prices implies lower feeder cattle prices with prices of lighter weight feeder cattle under more pressure than heavier feeder cattle.

---

Bull calves.

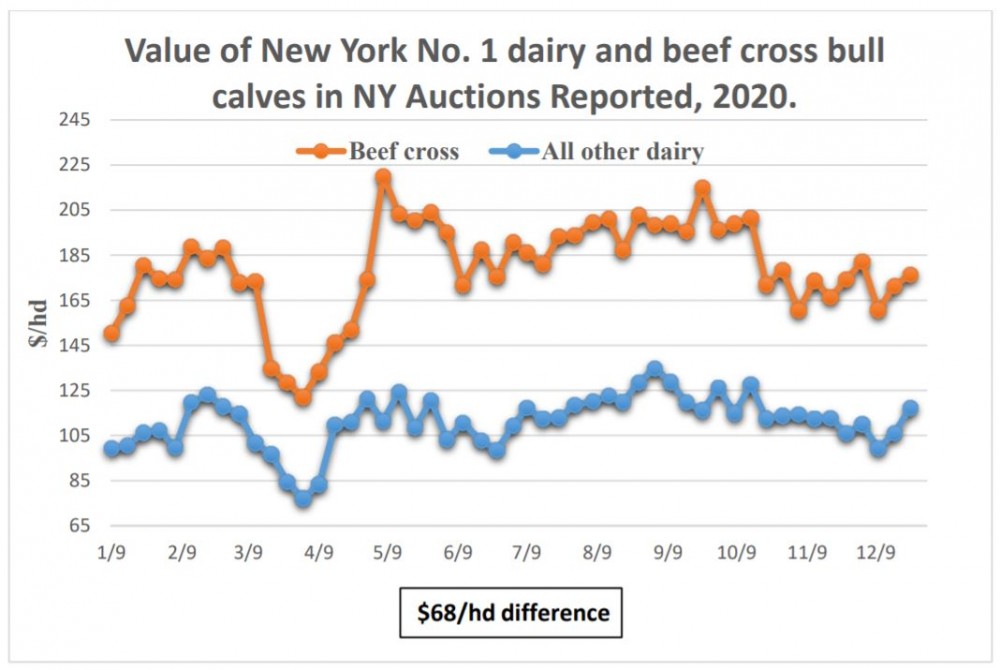

The 2020 average premium for beef cross bull calves was $68/hd with a range of $36/hd to $109/hd. The value of dairy and beef cross bull calves have increased since the beginning of the year, $13/hd for dairy and $24/hd for beef cross.

For additional information on NYS Auction prices go to: https://www.ams.usda.gov/market-news/feederand-replacement-cattle-auctions#NewFYork.

(Funds to support the NYS Market News program come from New York State Department of Agriculture and Markets project "Stocker cattle: Using underutilized grasslands to improve economic viability of the Southern Tier while providing viable careers for beginning farmers.")

Upcoming Events

Boots in the Barn: Cornell Dairy Research Updates

January 13, 2026

January 20, 2026

January 27, 2026

February 3, 2026

February 10, 2026

February 17, 2026

February 24, 2026

Join us for some or all!

Deerworm and Flukes in Small Ruminants Webinar

February 25, 2026 : Deerworm and Flukes in Small Ruminants Webinar

Dr. Mary Smith from Cornell's College of Veterinary Medicine and Dr. Rachel White from UMaine Cooperative Extension will be discussing the lifecycles, signs, prevention, and management of deerworm and liver flukes in small ruminants.

NYSDEC How to Get Certified Course

March 3, 2026 : NYSDEC How to Get Certified Course

Ellicottville, NY

NYSDEC training course in preparation to take the pesticide applicator exam.

Announcements

Cows, Crops & Critters Newsletter Sponsorship

TRYING TO REACH GROWERS AND AGRIBUSINESSES IN OUR SOUTHWEST REGION OF NEW YORK?Weekly Email Update: Shared with 625+ households who have signed up with our program.

Monthly Paper Mailer: To reach our stakeholders and farmers who lack internet access, we send out a monthly mailer where your company's logo and contact information would be featured with a mailing list of 330+ households.

If you sponsor our weekly and monthly publications you reach approximately 955 households.