Dairy Market Watch - March 2020

Katelyn Walley, Business Management Specialist and Team Leader

Southwest New York Dairy, Livestock and Field Crops Program

Dairy Market Response to COVID-19 and Early Spring Flush

By Katelyn Walley-Stoll, Cornell University Cooperative Extension

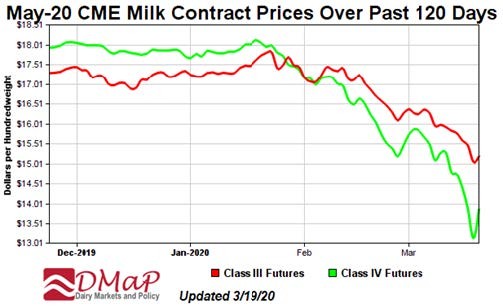

It's been a month. Looking back to price forecasts in December and January editions of Dairy Market Watch, producers were looking to expect $20 milk in 2020, with a close eye on export markets and projected milk production increases. With a more productive than expected start to our seasonal spring flush, and the COVID-19 pandemic, price projections have dropped drastically with future declines expected. Some forecasters have even gone as far as to avoid making any type of estimates with these uncertain times.

While grocery shelves are emptied of fluid milk, yogurt, and cheese as American families prepare for social distancing and, in some cases, shelter in place orders, it would be easy to think that this increase in demand could only lead to heartier milk checks. But, as businesses shut down, unemployment rises rapidly, and stock markets react to uncertainty, we are headed into a period of global economic decline that could mirror the 2008 Great Recession. Market buyers see prices dropping and are reluctant to purchase in large quantities, knowing that continued virus spread and increased spring flush milk loads will further drive prices down. As public schools close, which account for 8% of our total fluid milk consumption and a large portion of cheese orders, fluid milk markets are unsteady. Even though many are offering meal deliveries/pickups to their student populations, it won't be a one-for-one replacement. While milk production, and the food system as a whole, is safe and has been deemed essential, there are uncertainties surrounding workforce availability. Employees may become sick themselves, or stay home to care for sick family members or children home from school. Many plants have increased their hiring in anticipation, which will have cash flow implications as the year continues. Still, areas of the country are trying to meet fluid milk demand with limited production capacity and aging infrastructure. Additionally, as restaurants and food services close, or are limited to delivery/pick-up only options, cheese and butter demand has decreased. With an uncertain economy, the average consumer will also be more reserved with their purchases.

On a worldwide view, many of our main export market economies were already on the edge of economic downturn, the virus being the very large straw that broke the camel's back. Dry Products have also dropped on the futures markets with ample products available for buyers. As it stands now, Class IV futures have dropped below $14 through the next few months, rising to $15 by the end of the year. Class III is projected to hit a low of $14.50 this summer, and doesn't rise about $16 for the remainder of the year, averaging $15.92. This would be a drop of at least $1 as compared to 2019 for our 2020 averages. These numbers are constantly changing, responding to stock market shifts and virus impact estimates. If global economies improve over the year, and COVID-19 responses in place "flatten the curve", we could see prices rally, at least partially, towards the end of the year. But - this will have to coincide a slow in milk production increases. Using the indicators of our early spring flush, declining beef market prices, and producers trying to create more sound balance sheets following years of low prices, make this unlikely.

These are stressful times during what should have been a year of optimism and recovery. Farm owners should have a disaster plan in place and implement social distancing recommendations immediately. The average farm owner, and farm workforce, is at risk for contracting COVID-19 - we are not immune no matter how many salt blocks you licked as a kid. Employees of the farm might also be facing illness, childcare conflicts, and general anxiety over the situation. Be prepared to up your communications (from a safe distance), cross-train employees, and handle issues as they arise. If your cash flow is already looking tight, have a conversation with your banker sooner rather than later. Keep an eye out for upcoming relief packages that your farm business might qualify for. Most importantly, reach out. While we might need to stay away from people physically, the phones are still working. Call your neighbor, call your mentor, call your farm advisor, call NY FarmNet (1-800-547-3276). Reach out and stay connected!

Dairy Market Watch 2020 03 (March 2020) (pdf; 2043KB)

Upcoming Events

WNY Pastureland Conversion & Soil Health Field Day

July 16, 2025

Middleport, NY

Join American Farmland Trust for the Western New York Soil Health Field Day on July 16, 2025, at Zeliff Farm in Middleport, NY, from 9:00 AM-3:15 PM. Learn about pasture conversion, soil health benchmarking, biochar in grazing systems, and best grazing practices. Plus, enjoy hands-on demos with the NY Soil Health Trailer, drones, and cover crops! Check out the attached agenda for more information about the field day and REGISTER HERE. Zeliff Farms is a regenerative beef operation who has recently partnered with AFT on outreach and education to farmers including learning circles and evaluating biochar effects on soil health.

IPM Strategies to Protect Corn and Soybean Seed in NY

July 30, 2025

Hamburg , NY

SWNYDLFC and Cornell IPM are hosting a grower meeting to discuss integrated pest management strategies for protecting corn and soybean seed in New York.

FAMACHA Training for Sheep and Goat producers in Woodhull NY

August 13, 2025 : FAMACHA Training in Woodhull

Woodhull, NY

Join us for a discussion and hands-on training for internal parasite integrated pest management in sheep and goats. Certification is available to all students participating in the workshop.

Announcements

No announcements at this time.